Electric Vehicle Market

Published June 2024

– U.S. EV sales are projected to grow 12% this year, down from 28% and 60% growth in 2023 and 2022, respectively.

– The deceleration in EV demand and related price cuts have weighed on the profitability and share prices of EV companies.

– EV adoption is expected to accelerate in the coming years as charging infrastructure improves and EV prices come down.

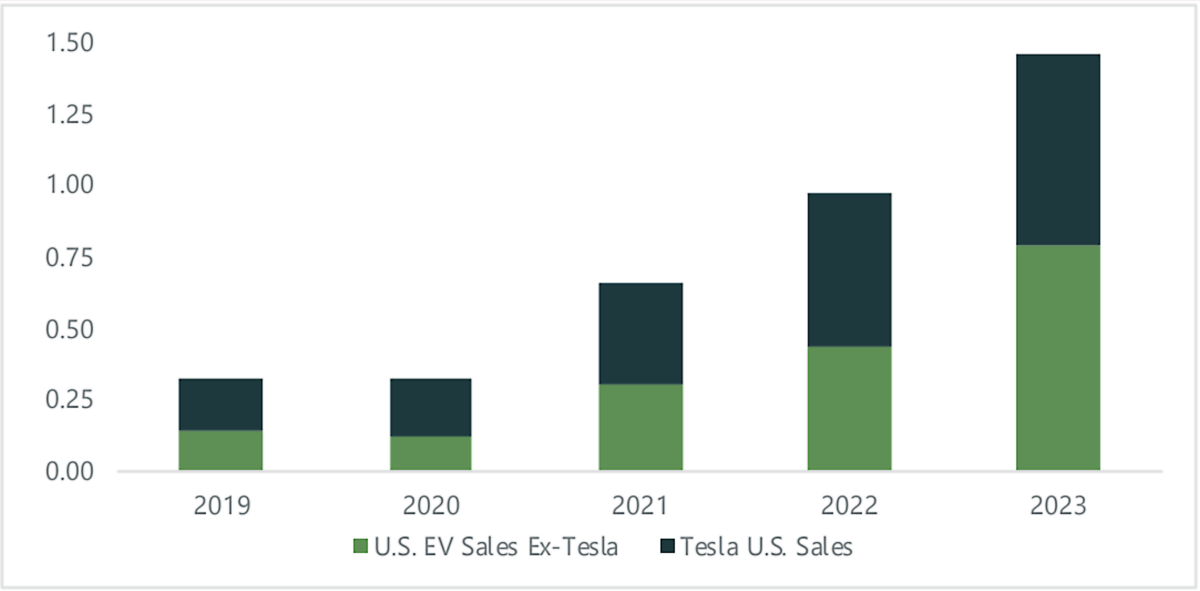

Global and U.S. electric vehicle (EV) sales are projected to reach another record year in 2024. However, the rapid slowdown in EV demand and reduced prices weighing on profitability has led to EV stocks including Tesla (TSLA), Rivian Automotive (RIVN), and Lucid Group (LCID) falling around 25% or more this year. Bloomberg’s equity analyst team projects U.S. EV sales will grow 12% this year, down from 28% and 60% growth in 2023 and 2022, respectively. Increasingly cost-conscious consumers are balking at EVs more expensive prices and have lingering concerns about insufficient charging infrastructure. U.S. EVs’ average price of $60,544 at the end of last year was around $13,000 (27%) more expensive than gas-fueled vehicles. Automotive manufacturers have cut EV prices aggressively this year to support demand, a trend labeled a “price war” by Ford’s Chief Executive Officer Jim Farley.

In addition to sticker shock, less financial support from government tax credits has added to EVs affordability challenge. The Inflation Reduction Act (IRA) signed into law in 2022 significantly reduced the number of EV models that qualify for the $7,500 tax credit. Only 13 EV models out of the roughly 60 models currently available in the U.S. are eligible for the tax credit. Qualifying for tax credits under the IRA requires EV models to be manufactured in the U.S., Canada, or Mexico. Meanwhile, battery materials must be sourced from a specific list of countries, which notably excludes China. Avoiding battery materials sourced from China is a difficult hurdle given the country is the largest producer of many critical minerals, including refining 60% of the world’s lithium, 65% of nickel, and 68% of cobalt.

“64% of Americans live within two miles of a public charging station”

Concerns about insufficient charging infrastructure in the U.S. have been another factor underlying some consumers’ reluctance to buy an EV. However, the rapid growth in charging stations in recent years has improved charging availability with 64% of Americans living within two miles of a public charging station. According to the U.S. Department of Energy, the country had around 160,000 public EV charging ports last fall, double the amount at the start of 2020. EV charging installations have been heavily concentrated in urban areas, but the IRA legislation’s tax credit incentives for EV charging outside urban areas appears to be helping as rural areas experienced higher growth in the number of charging stations than urban areas since the legislation was passed. Additionally, the Biden administration announced $623 million in federal grants earlier this year to build 7,500 charging stations and fund 47 EV charging infrastructure projects to help achieve the administration’s goal of having 500,000 public chargers by 2030.

U.S. consumers’ EV apprehension has led many buyers to prefer hybrid models over fully electric models. Consumer surveys suggest some Americans favor hybrids because they offer better gas mileage than traditional gas-powered cars and avoid charging concerns for longer distance traveling. Additionally, consumers have been attracted to hybrids lower price compared to fully electric models, which is largely due to having smaller batteries. According to Kelley Blue Book, the materials needed to make one fully EV battery can make 17 hybrid batteries. Consumer preferences have led several auto manufacturers, including Ford and General Motors, to scale back or delay their EV production plans to offer a wider vehicle lineup including hybrids.

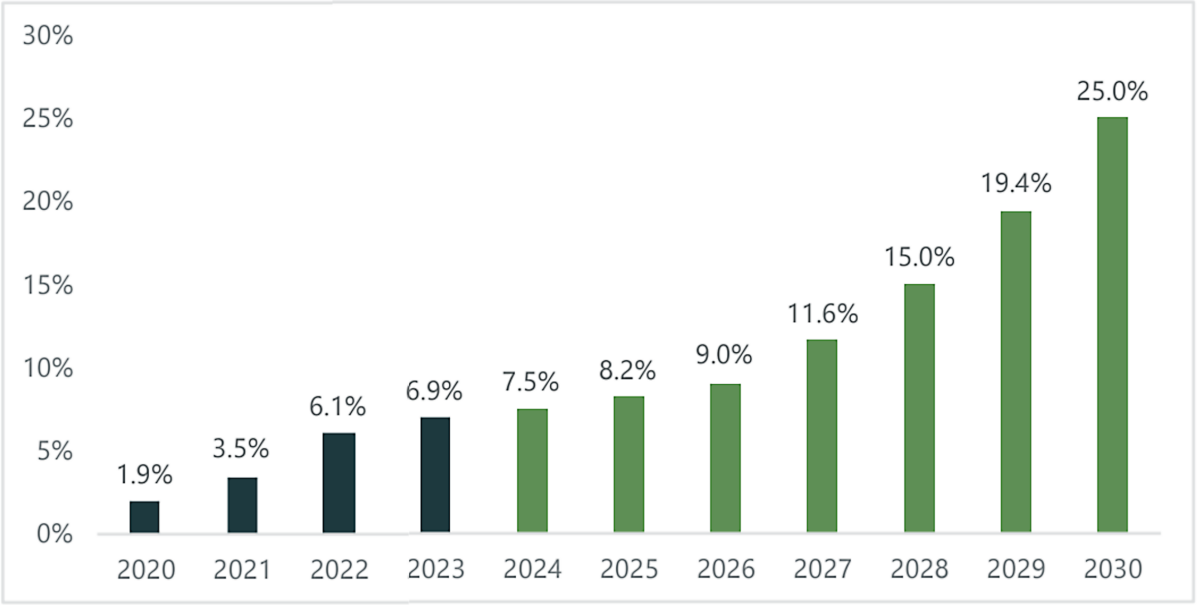

Electric Vehicle Percentage of New U.S. Vehicle Sales

Disappointing EV adoption in the U.S. compared to other countries may jeopardize the Biden administration’s ambitious goal of having EVs account for 50% of new vehicle sales by 2030. EV’s market share of U.S. new vehicle sales rose to 6.9% in 2023 from 6.1% in 2022. This is well behind EV market share of 15.7% in Europe and 22.8% in China. U.S. lackluster EV adoption has been partially attributed to Americans’ preference for larger cars (with not many EV offerings until recently) and so-called “range anxiety” stemming from uncertainty about the dependability of charging options for longer-distance trips. According to the National Automobile Dealers Association (NADA), trucks, SUVs, and crossovers accounted for 79.2% of new U.S. vehicle sales in 2022, up from 49.8% in 2012. This area of the EV market has fewer options than sedan models, but the number of larger model EV offerings is quickly growing. Americans’ longer average daily drive compared to European and Chinese drivers likely also hindered U.S. EV adoption because Americans are more dependent on charging infrastructure.

According to the American Automobile Association (AAA), Americans’ average daily drive distance was 32.7 miles in 2021 compared to 20.4 in Europe, and 19.8 in China.

Despite the challenging environment for EVs, the industry still has a favorable long-term outlook. Adoption is expected to accelerate in the coming years as charging infrastructure improves and EV prices come down because of cheaper battery materials. Improved economies of scale should lead to higher production volumes with lower manufacturing costs per unit. Bloomberg’s equity analyst team projects U.S. EV sales growth will average 23% from 2025 to 2030 and lead to EVs accounting for 25% of new vehicle sales by 2030.

U.S. Electric Vehicle Sales (Millions of Units)

by Dan Kupiec, CFA, Senior Investment Analyst at MainStreet Advisors

This report was prepared by Mainstreet Investment Advisors, LLC (“Mainstreet”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not constitute an endorsement of Mainstreet by the SEC nor does it indicate that Mainstreet has attained a particular level of skill or ability. Opinions herein are as of the publication date and are subject to change without notice. This report may include “forward-looking statements” which may or may not be accurate over the long term. Report includes candid statements and observations regarding investment strategies, asset allocation, individual securities, and economic and market conditions. Statements, opinions or forecasts are not guaranteed. Do not place undue reliance on forward-looking statements. Actual results could differ materially from those described. This material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon the client’s investment objectives. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy/sell any security or instrument or to participate in any trading strategy. The value of investments and the income derived from investments can go down as well as up. Future returns are not guaranteed, and a loss of principal may occur.

Source: Bloomberg, Morningstar, Wall Street Journal, CFRA Research