Discover Opportunities Beyond Traditional Investments

A comprehensive suite of alternative investment solutions include:

YOUR TRUSTED INVESTMENT OUTSOURCE PARTNER

MainStreet Advisors offers alternative investment solutions across all accreditation levels and liquidity preferences.

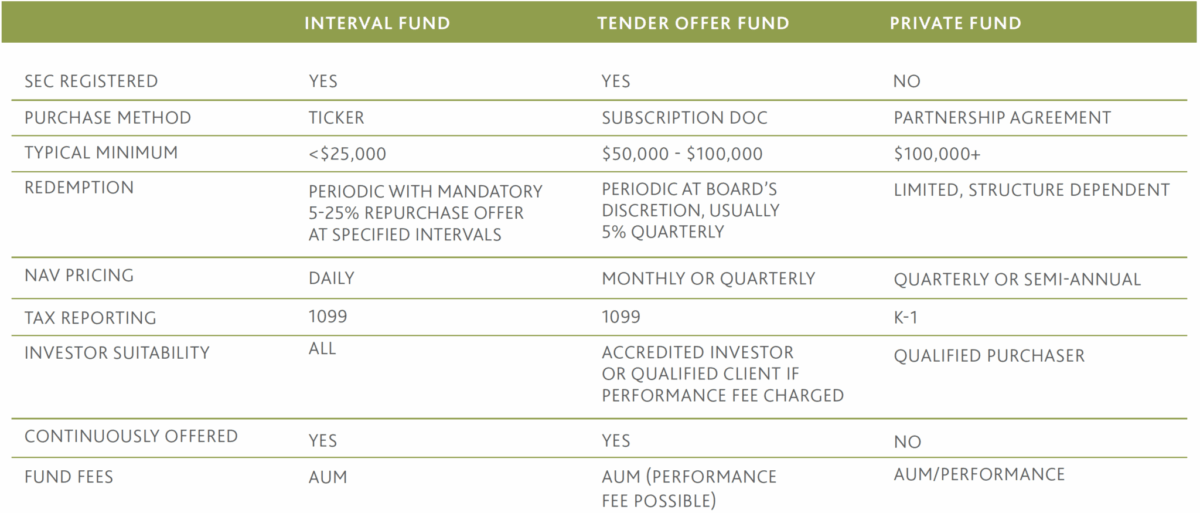

We utilize interval funds, tender offer funds, non-traded REITs, and private funds to deliver three core benefits:

Differentiated return profile through enhanced cross-asset diversification

Liquidity management aligned with investors’ cash flow needs

Access to institutional-quality alternative assets

Tailored to meet client goals, including:

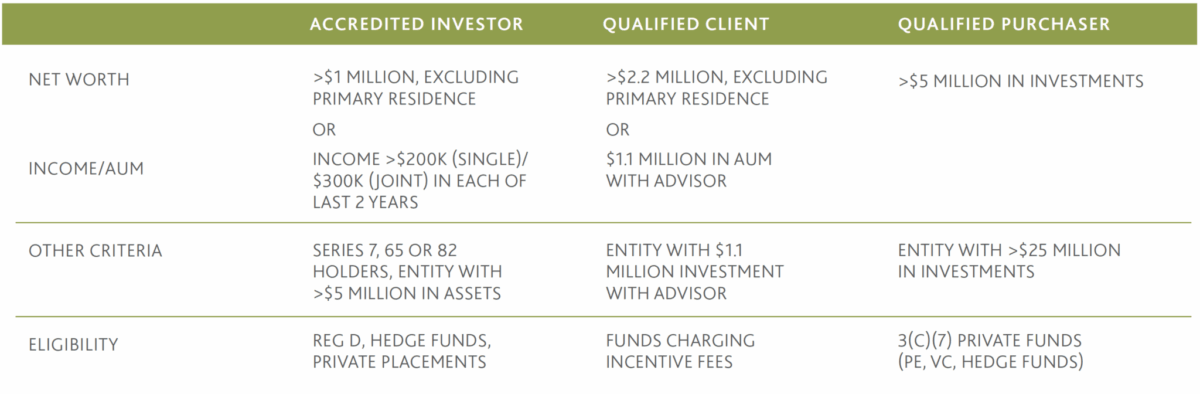

Alternative investments can be accessed through a range of structures designed to align with different investor profiles.

1. Identify your appropriate investor profile category

2. Choose the vehicle that best fit your qualifications and objectives